Using the Dashboard

Summary

Stores

Stores Tab Overview

Stores > Status

Stores > Technical

Stores > General

Web Based Store Inventory / Online Menu

Download a Pick List for easy restocking

Stores > Restock

How To Set Pars

Sales Tax

What is a KID?

Stores > Discounts

Stores > Financial

Products

Export Lots as CSV

Products > Transactions

Delete/Undelete (or Archiving) a Product

How to repurpose tags

How to Bulk Import Products

Products Overview

Products > Tag Orders

Export EPC Inventory

Products > Inventory

Add a Product

Products > Details

Tags

Transactions

Understanding Transaction Preauthorization and Processing Times

Transaction status definitions

Transactions > Logs

Coupon Reporting

Transactions > Customer Emails

Edit the default preauthorization amount

How to adjust a transaction or process a refund

How to View Transactions & Transactions Overview

How to Export Transactions for Enhanced Sales Analysis

How to prevent mischarges

Feedback

Discounts

Discounts > Add a Happy Hour Discount

Discounts > Add a Standard Discount

Discounts Overview

Discounts > Creating Coupons

Discounts > Add a Shelf Life Discount

How to redeem a coupon

How to end a Discount

Financials

Settings

Getting Started

Remittances

Transactions included in a remittance

Remittance Processing Schedule

How do I provide my banking information?

Ordering Tags

Restocking Product

Setting Up Your New Store

How to restock a Byte store

Setting up your store to be NAMA-certified

Custom graphics install instructions

Branding your store

Setting up your Byte Technology store

How soon will I receive my store?

Standard Byte Store Specs

Tagging Best Practices

Tagging Frozen Food

Tagging drinks

Tagging Non-Perishable Products

Product tagging best practices

Tagging sandwiches, wraps, and burritos

Tagging snacks or soft packaging

Tagging soups or yogurts

Tagging salads & hard packaging

Are RFID tags microwave safe?

Merchandising best practices

Test and verify inventory

Tagging heatable entrees

Tagging aluminum cans and foil-lined products

Dashboard Onboarding | A self-guided training

1. Introduction to Byte Technology Dashboard

2. Overview of Summary Page + Navigation Bar

3. Stores Section Overview

4. Products Section Overview

5. Transactions Section Overview

6. Feedback

7. Discounts Section Overview

8. Financials Section

9. Settings

10. Congratulations

Campus Card Stores

Byte Store Dimensions/Store Types

Troubleshooting & FAQs

Connectivity

How to Install an OptConnect Cellular Device on a Byte Store

Ethernet setup and networking requirements

Transactions made while store is offline

How do I get a store back online?

Code 400C

Code 600

Code C

Code E

No IP / Red or Yellow Border

Code 200

Sending Remote Commands

Screen Issues

Store Temperature

🧊 Why Your Dashboard May Show a Higher Temperature or “Too Warm” Status

Adjusting the store temperature

Inventory

Antennas in the Byte Store - Where to Place Your Products

Customer Inquiry: Need Help With Your Transaction?

Code 400

Door Lock Issues

Open a CSV file in Excel or Google Sheets

How to Reach Support

Combatting Theft With Your Byte Store

Error Codes: Out of Service Troubleshooting Guide

Internal Troubleshooting

- All Categories

- Using the Dashboard

- Stores

- Sales Tax

Sales Tax

Updated

by Carolina Villatoro

Updated

by Carolina Villatoro

Sales tax might be required to charge for purchases made at your Byte store depending on the location that the store is located.

Sales tax is easy to set and can be set at the Byte store level. Sales tax is reported per order, can be viewed on the transactions page, on the customer's receipt, and on a transaction export. This makes it easy to report for accounting and tax purposes.

To apply sales tax:

- Navigate to the Stores tab

- Select the Byte store you want to set

- Select Financials

- Select Edit

- Set Sales Tax Percentage (%)

- Click Save

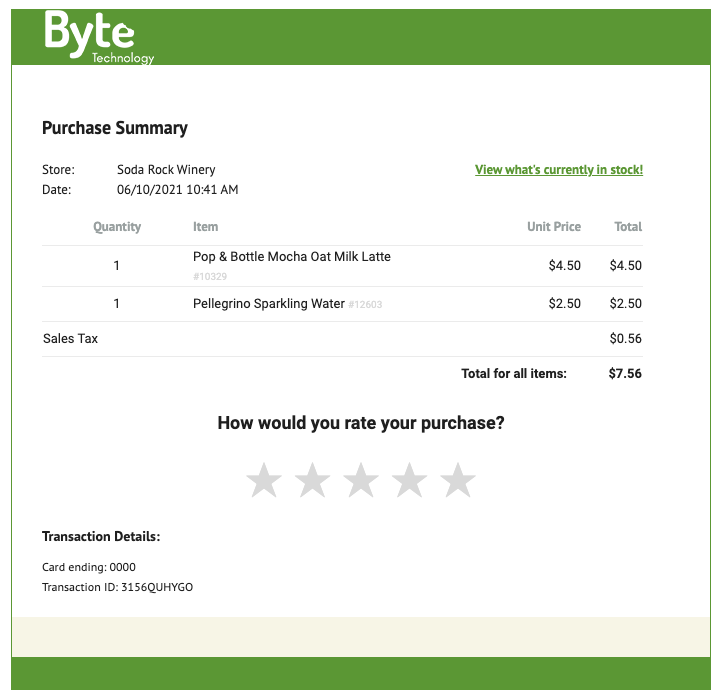

Customer View on Receipt

The customer will see an itemized receipt broken down by list price per item purchased, discounts (if applicable), sales tax, and order total.

Reporting Sales Tax:

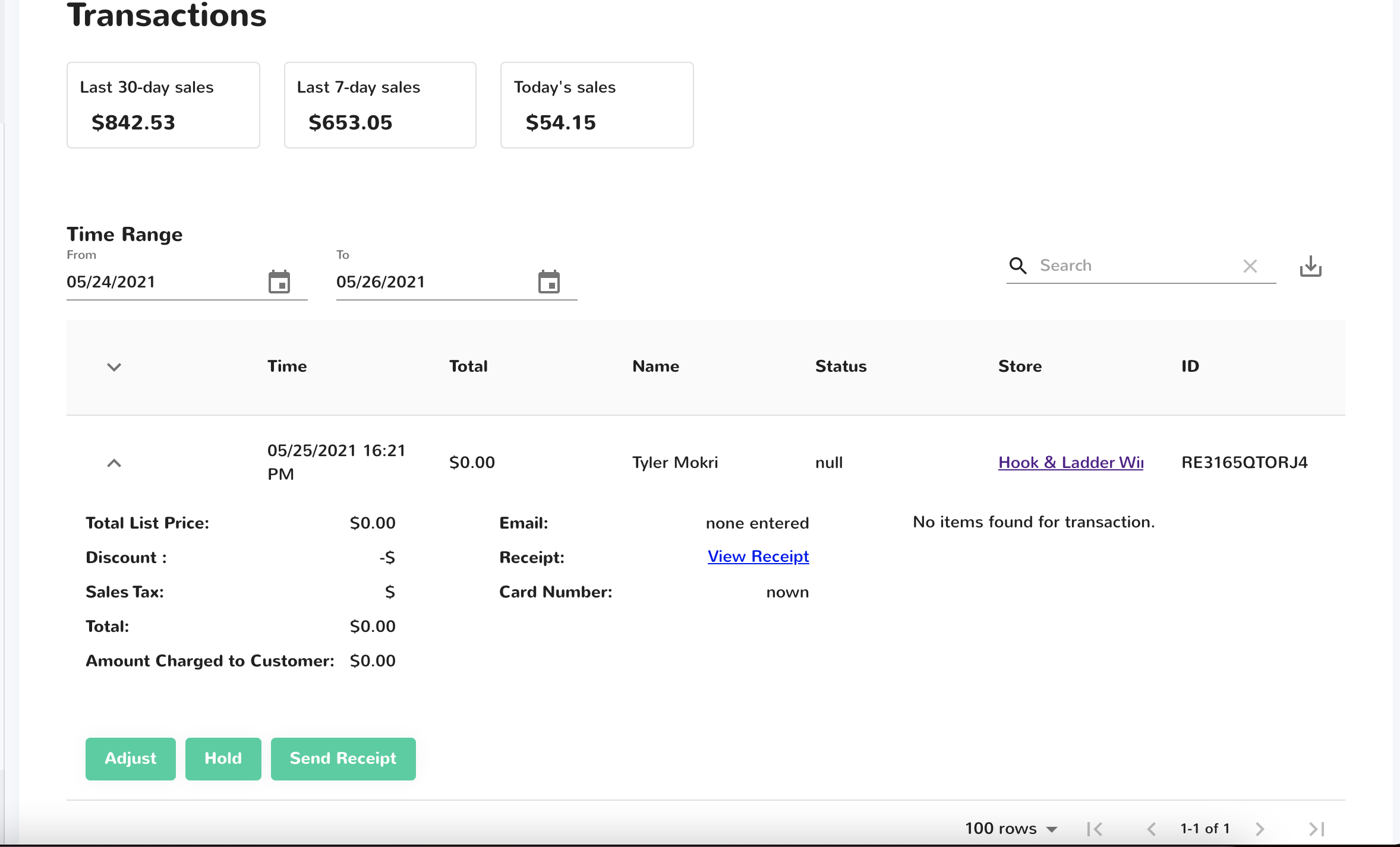

You can now view Sales Tax as a line item on your transaction view:

In your transaction export, you will be able to see the sales tax collected by item and by order. You will now see an added Sales Tax column located to the right of Total after Discounts.